Insights and Strategies

Housing Crisis or Opportunity?

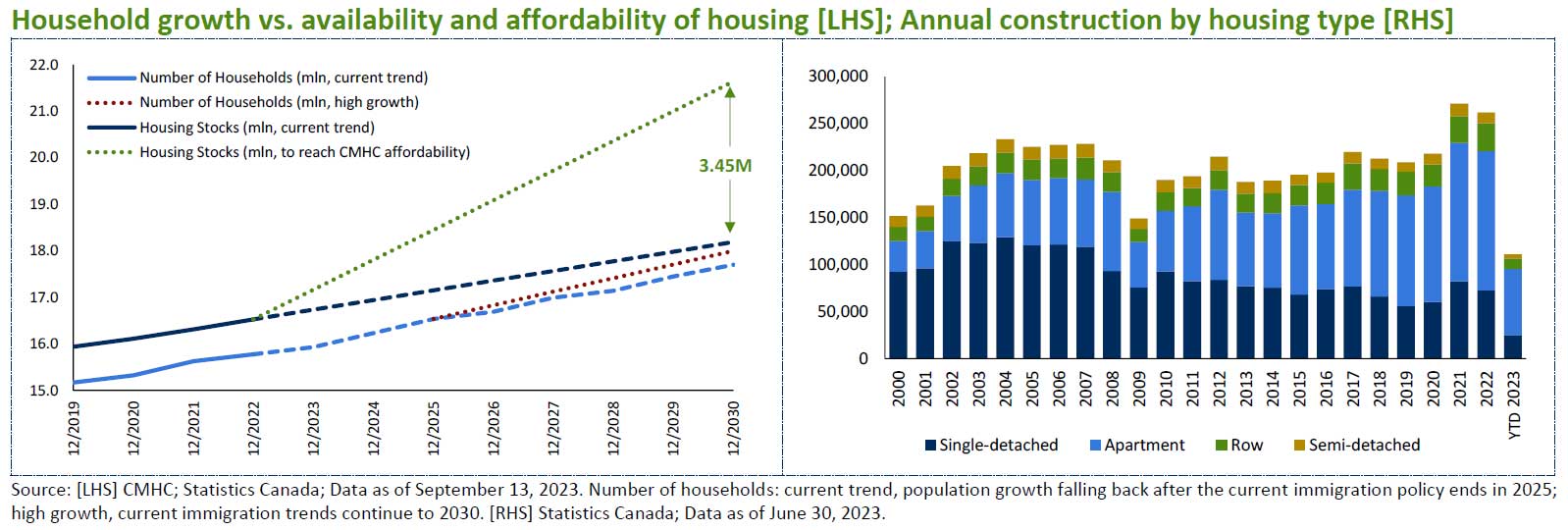

According to the Canada Mortgage and Housing Corporation (CMHC) update released in September, we will need 3.45 million additional housing units, beyond current build projections, to satisfy affordability needs to 2030. To clarify that headline, this is the number of units, beyond the 1.5 million units that are already expected to be built, needed to bring housing into CMHC’s “affordable” range. While there is definitely a housing affordability problem in Canada, as interest rate hikes have helped to push housing costs to 50 per cent of disposable income nationally, in Ontario and British Columbia that ratio is a staggering 60 per cent. Many readers may recall the convention in the 1970’s that housing costs should be 30 per cent of disposable income, or that this ratio fluctuated in the 35-40 per cent range for much of the last 20 years on a national basis. Depending on immigration and population growth assumptions, the current housing start forecasts indicate that availability and affordability is likely to, at best, stay similar to the current environment and are perhaps more likely to get worse. To achieve the affordability objectives laid out by the CMHC, we estimate that housing starts would need to more than triple from just over 200,000 per year currently, to roughly 700,000 per year, starting immediately.

Anyone familiar with the dynamics of supply and demand should quickly realize that this implies upward pressure on housing prices, although we also have to consider how affordability affects the number of potential participants in this market. The CMHC does do extensive analysis in household incomes in various regions, migration between provinces, and makes certain assumptions about population growth, including expecting the rate of immigration to decline past 2025, but with sensitivity analysis up to 700,000 immigrants per year. So, the question remains as to whether this could become an even more dramatic housing crisis and/or if this creates any opportunities for investors. Despite potentially short-term and perhaps regional volatility or weakness in housing prices, the foreseeable trend should be one of appreciating housing prices due primarily to supply and demand. As this also creates and aggravates affordability, more households will likely have to consider renting instead of buying, which likely creates opportunities in vehicles such as multi-family housing real estate investment trusts (REITs), and other rental property assets. If we do see heightened levels of construction, towards the CMHC’s targets, we could see opportunities in building equipment, supplies, and services.